Getting Started

Setting up your Job Board account

How to connect Quickbooks Online to the Job Board version

Launch jobs from Orders - Job board version

Job Board Only version Vs Pro version

Setting up your Pro account

Flagging a user as a "Sales Rep"

shopVOX Pro User Types

Forms: Editing the User Interface

How to Change Password

How Do I Create a New User?

What size should my logo be so it can appear in email PDFs?

Account Settings for your Pro account

shopVOX Work Flow - The Big Picture

Roles: How to restrict access for certain users

Protect Your Bottom Line with Terms and Conditions

Transferring data from my old system to shopVOX

POS Settings - General

Outsourced PO PDF - details your Vendors need to know

PDF Settings

How are Users Billed?

Common Questions About Users

How to import your customers and contacts from a spreadsheet

How to configure the SMTP settings for your email

User Roles and Permissions Explained

POS Settings – Sales Taxes

Five challenges to consider when setting up your Account

Adding new customers

shopVOX Pro Job board Filters

Training resources

Pricing

Create your first Pricing Template - a visual guide

What is a product?

shopVOX Pricing Templates

Building a Product: The Basics of Using Pricing Templates

Accounting sync setup

Transaction Number Sequencing

Setup Xero accounting integration

Common QB Questions

shopVOX Setup of Tax Codes for Quickbooks Canada Desktop/Online

How to Connect to Quickbooks Online using the Setup Wizard

How to Connect to Quickbooks Desktop version using the Setup Wizard

How to setup Sage Business Cloud Accounting integration

Getting started Guide

Save Time with Emailed Document Templates

Notifications: Keep your entire team up to date

shopVOX Compatibility

Top 10 flows in shopVOX for a typical shop

Introduction to ShopVOX

How to create a Sales Order

Microsoft Outlook - Two Factor Authentication

Avalara AvaTax - Sales tax setup guide

Sales

Managing Customer and Leads

Managing dates on Quotes, Sales Orders, and Invoices

How to Add a Special Note to a Customer Document ?

How Do I Group Contacts Together?

Customer Alerts & Flags

Inactive Customers Report

How Do I Group Customers Together?

Merge Customers

Adding new Contacts to Existing Customers

Set up different pricing levels for different customers

Update: Editing Existing Contacts - GDPR Compliance

What are Sales Leads?

Sales Lead or straight to Quote?

Sample Sales Lead Pipeline

What is a CRM system?

Win more business with Sales Leads

Why use Sales Leads?

Sales Leads Guide

Create Sales Leads automatically from the contact form on your website

How do I add a Quote from a Sales Lead?

Sales Order States

How to Create a New Sales Lead in shopVOX

How to Create a Quote

Sales goals - Setting up for Success!

Drive results with the Sales - Production Thermometer

Adding Shipping Charges to a Transaction

Quote Approval Email Feature: Adding Attachments

Use the Roll Up feature to combine pricing for multiple line items

Quote States

Adding Images to a Quote/Sales Order/Invoice PDF

What is the Sales Process?

Quote Review - Send Approval Email

How to use the Quick Quote Feature

What is a Sales Pipeline?

Mark invoices as Delivered, Shipped or Picked up

Quoting Screen Printed Apparel

Products & Pricing

Basic Pricing concepts

What are Pricing Types?

Create Your First Product

What is the difference between Standard, Cost+ and Product Pricing?

How do I add a product category?

Pricing Attributes

Materials - Understanding, Adding and Adjusting

Labor Rates and Machine Rates

Shipping, Setup, Finance & Miscellaneous Charges

Building a Product and understanding Pricing Templates. Watch the webinar!

Building Products using Grid Pricing

Pricing products using the Panels UI

Using Variants for different Pricing Structures

Advanced Pricing concepts

Modifying Starter Products: Remove installation and design services if they are not taxable in your area.

Setting up second side pricing for a Product

Vendor Pricing: adding to Materials

Using Logic in your Pricing Templates

How does Wastage work in shopVOX?

Job Costing - Estimated vs. Actual

Modify Material, Labor rate & Machine rate formulas within a Product

Deactivating and Deleting Products

How to make your invoice line items editable

Re-Calculating Bill Of Materials (BOM)

What's the difference between Margin, Markup %, and Markup Multiplier ?

How to adjust the bill of materials (BOM) for situational purposes

No Total PDF: How to give a customer options without totaling the whole Quote

What is the Sell/Buy Ratio?

Customizing Line Item Descriptions

Custom Fields in shopVOX

How to increase prices for your Products by a percentage

Setting up Products priced by the Square Inch

Product: Business Cards using Grid Pricing

Adding Pricing Template to a Grid Product

Problems with Grid Product - Who can I contact for help?

How to Import Grid Pricing from a Spreadsheet ?

What is the difference between range and volume discounts?

How can I give a discount for a product for a single customer?

Grid Pricing Webinar

Examples of Grid Pricing Products

Master Pricing Guide

Production Management

Job Board management

Adding your Job Board to your TV

Why create jobs and use the job board?

How to Generate a Completed Jobs Report

A guide to the Job Board

Job Board - Different Views

Change default job view

Full screen Job Board

Making Job Board Line Items More Unique

How and when to use Create Combined Jobs

Workflow templates

Proofing

How to upload a proof to your job ?

How do I send Multiple versions as options to the customer to choose from?

How do I send several proofs for the different items on my transaction?

Does shopVOX support multiple page proofs?

Get artwork approved faster with Online Proofing

Scheduler

Managing your schedule with the Shop Calendar and Shop Scheduler

Shop Calendar and Shop Scheduler: Overview - is it right for my shop?

Will changes made on an Invoice or Sales Order Line item be updated to the Work Order details?

Is Inventory for Me?

How Do I Require a Payment before a Job can be started?

Using Create Combined Job to group line items for production

What are Projects?

Material Requisitions

Accounting and Reporting

QuickBooks Online

How to export customer data from QuickBooks Online

Quickbooks Online: Common Sync Errors

Automatic Sales Tax Rates and QuickBooks Online

How to Sync to Quickbooks Online

ACH Payment

QuickBooks Desktop

How to export customers & contacts from Quickbooks Desktop?

Quickbooks Desktop: Common Sync Errors

How to Sync to Quickbooks Desktop

Xero

Reports

How to send invoice statements to customers with the Collections report

Daily Sales and Payments report

Daily Activity Report

How to create progress invoices ?

Sales Tax Groups and Combined Tax Rates

MYOB Export & Sage 50 Export

How to refund credit card transactions processed via shopVOX & Authorize.net

Square Payment Integration

Prevent QuickBooks sync errors by excluding special characters and limits

Take in-store credit card payments with a USB credit card swiper

Sales Commission

Line item Taxable / Non-Taxable logic - Video

How Do Credit Memos and Refunds Work in shopVOX?

Differences between USA QuickBooks Online and Non-USA QuickBooks Online

Accounting wins! Strategies for using shopVOX for business growth.

Creating & sending Statements in shopVOX

Sales Tax Rates

Industry Specific Content

Sign Industry

How to Price Vinyl Printing

How to Price Banners

How to Price Banner Stands

Pricing Scenarios: Banners

Product: Yard Signs using Grid Pricing

How to Price Vehicle Wraps

Apparel Industry

Promotional Items: adding Labor cost & Base Product cost to Purchase Orders

Adding your own Variants for Embroidery and Screen Printing

How do I stop the price for my apparel from recalculating when I update the quote or sales order?

How do I add customer supplied garments to a quote or sales order?

Blank Apparel - Integrated Supplier Catalogs

Adding Promotional Products to your Quotes and Sales Orders

Dynamic Size Selection on Apparel UI

Apparel UI - Catalog Pricing Flag

How to add Screen Printed Apparel to Quotes and Sales Orders ?

How to price Screen Printing

How to customize the standard Screen Printing locations

How do I quote multiple options or quantities of shirts or hats?

How to price Screen Printing - case study

How do I add apparel styles that aren't listed in the integrated catalogs?

Importing custom catalogs for apparel from other suppliers

How do I see a detailed breakdown of cost and price of apparel?

How do add additional apparel styles or colors to a quote or sales order?

Apparel Decoration Order Guide

Master Guide to Apparel Decoration

MSRP Catalog pricing - setting a Fixed price for Apparel items

SanMar apparel catalog integration

Automation & Integrations

Shipping

UPS Shipping Integration - Access Keys

FedEx Shipping Integration

Creating a shipment

Shipping Profiles

APIs

shopVOX API

How does an API work?

What is JSON?

Where can my get my shopVOX API credentials?

What is an API?

Can the shopVOX API accept tracking numbers on shipped orders?

Does shopVOX do custom development?

Setting up the Gmail and Outlook Email Integrations with @mail feature

Master Guide to Automation & Integration

How to update your current contact form integration to include uploaded files

What are some popular advantages when using Zapier?

How to add form submissions as Sales Leads in shopVOX

How to send Shopify orders to Sales Orders in shopVOX

shopVOX Go!

How to add Third party Shipping account to a Customer ?

I'm having an issue with the shopVOX APIs. Who do I contact?

How do I build my own custom integration?

Does shopVOX integrate with Salesforce?

Does shopVOX integrate with Microsoft Project?

How Purchase orders work in shopVOX

Setting up Mailchimp integration

Customize your account with Add-on Features

Scheduled Actions - What are they and what can I do with them

API/WebHooks integration feature

Setting up Constant Contact integration

FAQs

shopVOX specific terms

What happens when a Job is completed?

QuickBooks - Classes

Key terms explained

Divisions Add-On

Uploading vs Linking Assets

Why doesn't Material have Volume Discount, only Range Discount?

What does Capacity in Minutes mean?

Common questions

Why can't I print the PDF documents directly, instead of downloading?

How can I print invoices to mail to my customers?

I can't use my email address? shopVOX says email has already been taken.

How do I re-activate the disabled user?

How can I send a quote and a proof together in one email to my customer?

Where do jobs "fit" in the order process in ShopVOX?

What is the Admin checkbox for when creating a new user?

How to Set Up and Use the Inventory Feature

How can I change the workflow template for a job?

How Can I Upload an Image of a Product on a Job Line Item?

Customers- Credit Limits, Stop Supply & Disable

What Does "Group" Mean When Creating a New Customer?

New to Quickbooks While Using ShopVOX

How to increase Database size ?

Hex Color file to match PMS color chart

Can customers download uploaded proofs?

How do I update contact info?

How can I raise a PRO-FORMA or DOWN-PAYMENT Invoice?

How do I add new products?

Can we chat internally with other users?

How to enable login only from static IP address

How can I delete a job?

Who should be assigned the Customer Review step in online proofing?

Opening PDFs directly in your browser

How to hide the thumbnail image in proof emails

What does the number next to workflow steps mean?

Bulk deleting customers

Optimization tips for the Job board

Errors and Troubleshooting

How do I remove / delete materials, material types, or material categories?

When I convert a quote to a work order, does the name of the order and the line item description carry forward or do I have to rewrite?

shopVOX Chat Feature not working on Firefox Browser

How to clear history from Chrome browser?

Flags to control what prints on customer facing vs internal PDFs

Keep Important Documents Handy with Account Level Assets

How to round your pricing to 2 decimals or 4 decimals

ERROR - Property: amount_in_cents, reason: greater than payment balance.

Control custom line items

Existing Approved Proofs for ReOrders

Advanced Search & Filters

How do I cancel my account?

Powerful Global Search in shopVOX

How can I setup a minimum order amount?

How to optimize your browser for shopVOX

Unable to change the Customer on Order ?

Asset Images and using Image Notes

What is our IP address for the mail server ?

Custom PDF in shopVOX

shopVOX Job Board version

eCommerce

Taking Payments in ShopVOX - what your customers will see

Setup a private storefront for your clients to place orders with a cPortal

How do I enable the free cPortal for a customer?

What is the difference between the Paid and Free versions of cPortal?

Online Ordering Account settings for cPortals & Shopping Cart

How is online payment processing set up?

Webstore & Shopping Cart Examples from shopVOX Users

Webstores for your customers - What are they? and... How to setup!

How to setup Products for a given customer to be able to order from cPortal?

White Label setup instructions

Steps to setup custom URL for paid cPortal

Setting up a Shopping Cart to sell online

What will my customers see on their cPortal?

Webstore vs Shopping Cart

How to create a Discount Code in the eCommerce feature

- All Categories

- Accounting and Reporting

- How Do Credit Memos and Refunds Work in shopVOX?

How Do Credit Memos and Refunds Work in shopVOX?

This article should help you know the best use case for credit memos and refunds. Refunds in shopvox serve the purpose of representing actual money given back to a customer from a payment. Credit Memo's on the other hand are usually for internal use. They allow you to generate a formal statement/document that records a credit or adjustment that modifies that the balance of an invoice (only). Sometimes you'll need to refund and create a credit memo, other times you'll just do one or the other. Keep reading, I hope this helps!

About Credit Memos

A credit memo is a commercial document issued by You (the seller) to a customer (the buyer) or for internal purposes. You'll usually issue a Credit Memo to raise or lower the invoice balance. You may also use a credit memo in the event the order was cancelled or modified by you or the customer AFTER the Sales Order was converted to an Invoice (after the customer was invoiced). If there were payments added to an invoice, they can be issued back as a refund or held as a Credit for future orders.

Here are some situations to consider of when you might use Credit Memos:

- Your customer has already paid the full amount and you agree to give a credit to be used on future orders. In this scenario, create a credit memo and then record some sort of refund on the invoice.

- Customer made a partial payment, and an agreement was made to credit part of the order. In this scenario, create a credit memo for the credit amount. If done properly this credit memo will now show that the invoice balance owed is 0. This credit memo represents your company taking a hit/loss on the invoice, it also satisfies the remaining balance so it falls off the collections module.

- If the balance on an invoice shows negative this technically means you owe the customer, so you would issue a refund to fix this negative balance on the invoice.

- Some times customers make payments that are nominally short or over (+/- $1 depending on your currency). In these instances, credit memos allow you to correct/reconcile these discrepancies toward the invoice so that they are removed from your collection reports. They are a great way to get invoices to a zero balance.

How to Create a Credit Memo

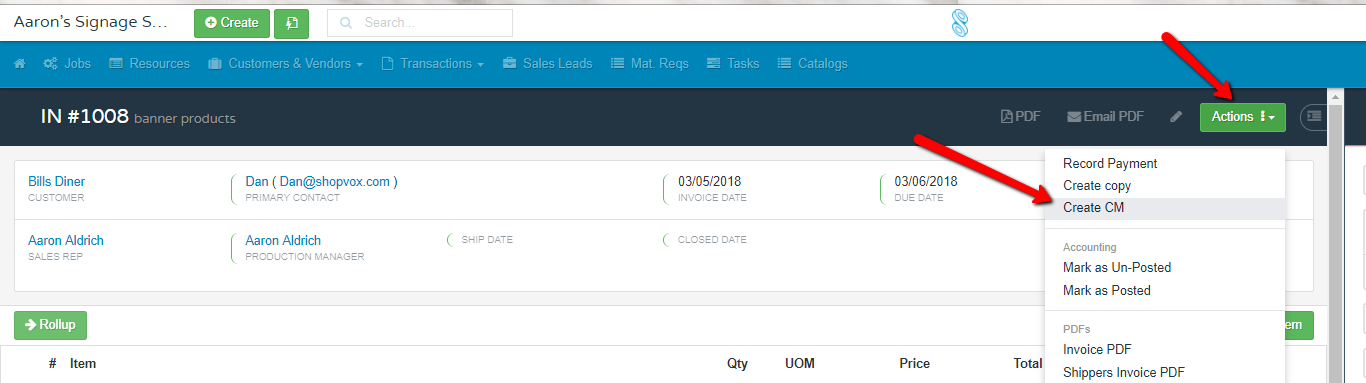

In ShopVOX, you can ONLY create Credit Memo's from invoices (not sales orders or estimates)

On the selected Invoice:

- Click on the green Action button

- Click on Create CM

- Confirm what you will be crediting (select any line items you want on the CM)

- Click Save at the bottom of the screen to create the Credit Memo.

After you confirm and Save, a new transaction of the type "Credit Memo" is created with all the exact same line items (if you choose to do so), prices, sales commissions etc., on the Credit Memo. You can modify these, you can check/look at the balance on the invoice to see how the CM is calculating/effecting the big picture.

Once Credit Memos and Refunds are created, the Invoice should now be reconciled with Credits and Refunds to get to zero net balance on an Invoice.

You cannot create Credit Memos directly...they can only be created from an Invoice.

More ideas on how to :

- Create a credit memo with one or more line items of the existing Invoice

- Create a credit memo for the whole invoice

- Create a credit memo with a partial of a line item

- Create a credit memo with a totally different line item which does not exist on the original invoice

Credit Memos can sync to Quickbooks.

About Refunds

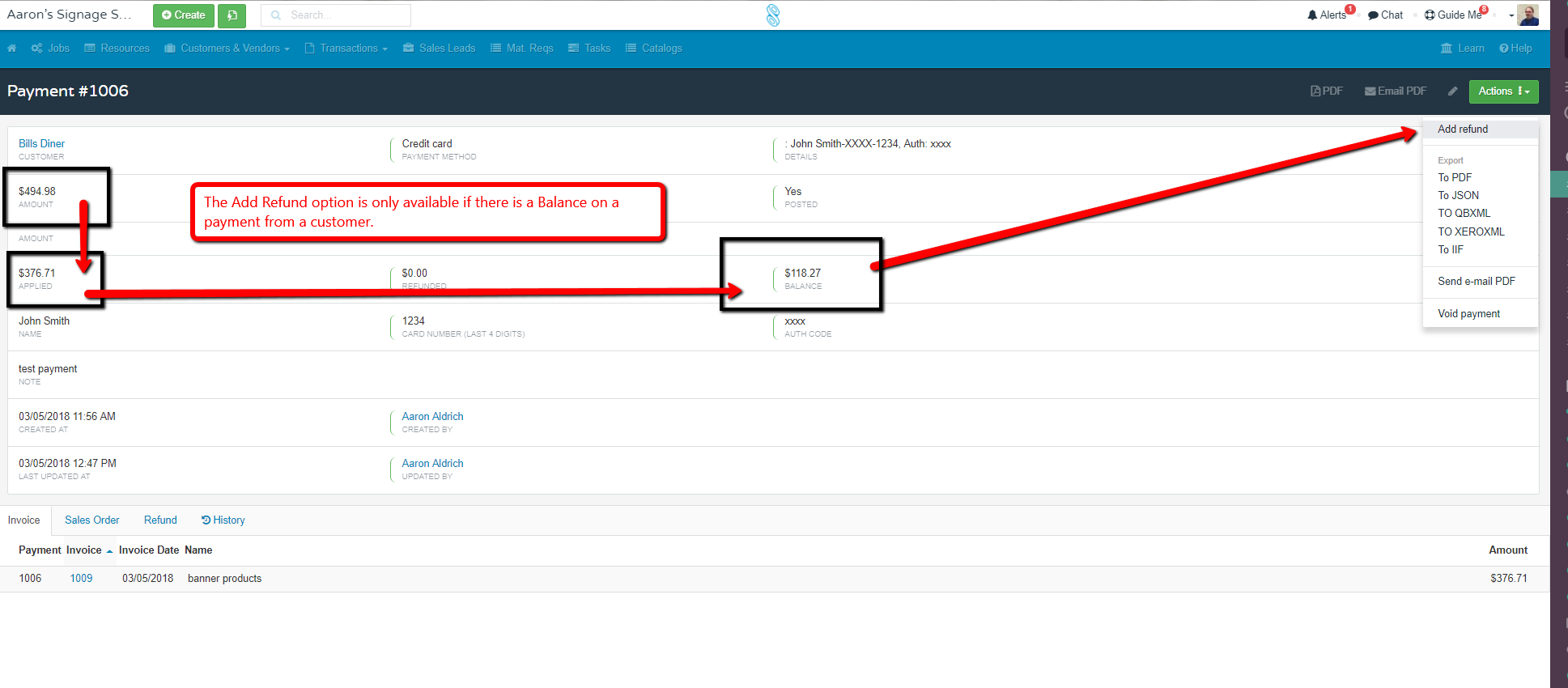

Refunds can be created from payments which are larger than the balance of the Sales Orders/Invoice (show as a negative number on the invoice). For instance, if your customer over paid you and you wanted to return the funds; you would then need to create a refund. The refund option is only available if there is an over payment or additional funds from the customers payment.

A Refund is created from the Payment screen, which can be accessed by choosing a customer.

- Click the Payments link

- Click Payment # in question