Getting Started

Setting up your Job Board account

How to connect Quickbooks Online to the Job Board version

Launch jobs from Orders - Job board version

Job Board Only version Vs Pro version

Setting up your Pro account

Flagging a user as a "Sales Rep"

shopVOX Pro User Types

Forms: Editing the User Interface

How to Change Password

How Do I Create a New User?

What size should my logo be so it can appear in email PDFs?

Account Settings for your Pro account

shopVOX Work Flow - The Big Picture

Roles: How to restrict access for certain users

Protect Your Bottom Line with Terms and Conditions

Transferring data from my old system to shopVOX

POS Settings - General

Outsourced PO PDF - details your Vendors need to know

PDF Settings

How are Users Billed?

Common Questions About Users

How to import your customers and contacts from a spreadsheet

How to configure the SMTP settings for your email

User Roles and Permissions Explained

POS Settings – Sales Taxes

Five challenges to consider when setting up your Account

Adding new customers

shopVOX Pro Job board Filters

Training resources

Pricing

Create your first Pricing Template - a visual guide

What is a product?

shopVOX Pricing Templates

Building a Product: The Basics of Using Pricing Templates

Accounting sync setup

Transaction Number Sequencing

Setup Xero accounting integration

Common QB Questions

shopVOX Setup of Tax Codes for Quickbooks Canada Desktop/Online

How to Connect to Quickbooks Online using the Setup Wizard

How to Connect to Quickbooks Desktop version using the Setup Wizard

How to setup Sage Business Cloud Accounting integration

Getting started Guide

Save Time with Emailed Document Templates

Notifications: Keep your entire team up to date

shopVOX Compatibility

Top 10 flows in shopVOX for a typical shop

Introduction to ShopVOX

How to create a Sales Order

Microsoft Outlook - Two Factor Authentication

Avalara AvaTax - Sales tax setup guide

Sales

Managing Customer and Leads

Managing dates on Quotes, Sales Orders, and Invoices

How to Add a Special Note to a Customer Document ?

How Do I Group Contacts Together?

Customer Alerts & Flags

Inactive Customers Report

How Do I Group Customers Together?

Merge Customers

Adding new Contacts to Existing Customers

Set up different pricing levels for different customers

Update: Editing Existing Contacts - GDPR Compliance

What are Sales Leads?

Sales Lead or straight to Quote?

Sample Sales Lead Pipeline

What is a CRM system?

Win more business with Sales Leads

Why use Sales Leads?

Sales Leads Guide

Create Sales Leads automatically from the contact form on your website

How do I add a Quote from a Sales Lead?

Sales Order States

How to Create a New Sales Lead in shopVOX

How to Create a Quote

Sales goals - Setting up for Success!

Drive results with the Sales - Production Thermometer

Adding Shipping Charges to a Transaction

Quote Approval Email Feature: Adding Attachments

Use the Roll Up feature to combine pricing for multiple line items

Quote States

Adding Images to a Quote/Sales Order/Invoice PDF

What is the Sales Process?

Quote Review - Send Approval Email

How to use the Quick Quote Feature

What is a Sales Pipeline?

Mark invoices as Delivered, Shipped or Picked up

Quoting Screen Printed Apparel

Products & Pricing

Basic Pricing concepts

What are Pricing Types?

Create Your First Product

What is the difference between Standard, Cost+ and Product Pricing?

How do I add a product category?

Pricing Attributes

Materials - Understanding, Adding and Adjusting

Labor Rates and Machine Rates

Shipping, Setup, Finance & Miscellaneous Charges

Building a Product and understanding Pricing Templates. Watch the webinar!

Building Products using Grid Pricing

Pricing products using the Panels UI

Using Variants for different Pricing Structures

Advanced Pricing concepts

Modifying Starter Products: Remove installation and design services if they are not taxable in your area.

Setting up second side pricing for a Product

Vendor Pricing: adding to Materials

Using Logic in your Pricing Templates

How does Wastage work in shopVOX?

Job Costing - Estimated vs. Actual

Modify Material, Labor rate & Machine rate formulas within a Product

Deactivating and Deleting Products

How to make your invoice line items editable

Re-Calculating Bill Of Materials (BOM)

What's the difference between Margin, Markup %, and Markup Multiplier ?

How to adjust the bill of materials (BOM) for situational purposes

No Total PDF: How to give a customer options without totaling the whole Quote

What is the Sell/Buy Ratio?

Customizing Line Item Descriptions

Custom Fields in shopVOX

How to increase prices for your Products by a percentage

Setting up Products priced by the Square Inch

Product: Business Cards using Grid Pricing

Adding Pricing Template to a Grid Product

Problems with Grid Product - Who can I contact for help?

How to Import Grid Pricing from a Spreadsheet ?

What is the difference between range and volume discounts?

How can I give a discount for a product for a single customer?

Grid Pricing Webinar

Examples of Grid Pricing Products

Master Pricing Guide

Production Management

Job Board management

Adding your Job Board to your TV

Why create jobs and use the job board?

How to Generate a Completed Jobs Report

A guide to the Job Board

Job Board - Different Views

Change default job view

Full screen Job Board

Making Job Board Line Items More Unique

How and when to use Create Combined Jobs

Workflow templates

Proofing

How to upload a proof to your job ?

How do I send Multiple versions as options to the customer to choose from?

How do I send several proofs for the different items on my transaction?

Does shopVOX support multiple page proofs?

Get artwork approved faster with Online Proofing

Scheduler

Managing your schedule with the Shop Calendar and Shop Scheduler

Shop Calendar and Shop Scheduler: Overview - is it right for my shop?

Will changes made on an Invoice or Sales Order Line item be updated to the Work Order details?

Is Inventory for Me?

How Do I Require a Payment before a Job can be started?

Using Create Combined Job to group line items for production

What are Projects?

Material Requisitions

Accounting and Reporting

QuickBooks Online

How to export customer data from QuickBooks Online

Quickbooks Online: Common Sync Errors

Automatic Sales Tax Rates and QuickBooks Online

How to Sync to Quickbooks Online

ACH Payment

QuickBooks Desktop

How to export customers & contacts from Quickbooks Desktop?

Quickbooks Desktop: Common Sync Errors

How to Sync to Quickbooks Desktop

Xero

Reports

How to send invoice statements to customers with the Collections report

Daily Sales and Payments report

Daily Activity Report

How to create progress invoices ?

Sales Tax Groups and Combined Tax Rates

MYOB Export & Sage 50 Export

How to refund credit card transactions processed via shopVOX & Authorize.net

Square Payment Integration

Prevent QuickBooks sync errors by excluding special characters and limits

Take in-store credit card payments with a USB credit card swiper

Sales Commission

Line item Taxable / Non-Taxable logic - Video

How Do Credit Memos and Refunds Work in shopVOX?

Differences between USA QuickBooks Online and Non-USA QuickBooks Online

Accounting wins! Strategies for using shopVOX for business growth.

Creating & sending Statements in shopVOX

Sales Tax Rates

Industry Specific Content

Sign Industry

How to Price Vinyl Printing

How to Price Banners

How to Price Banner Stands

Pricing Scenarios: Banners

Product: Yard Signs using Grid Pricing

How to Price Vehicle Wraps

Apparel Industry

Promotional Items: adding Labor cost & Base Product cost to Purchase Orders

Adding your own Variants for Embroidery and Screen Printing

How do I stop the price for my apparel from recalculating when I update the quote or sales order?

How do I add customer supplied garments to a quote or sales order?

Blank Apparel - Integrated Supplier Catalogs

Adding Promotional Products to your Quotes and Sales Orders

Dynamic Size Selection on Apparel UI

Apparel UI - Catalog Pricing Flag

How to add Screen Printed Apparel to Quotes and Sales Orders ?

How to price Screen Printing

How to customize the standard Screen Printing locations

How do I quote multiple options or quantities of shirts or hats?

How to price Screen Printing - case study

How do I add apparel styles that aren't listed in the integrated catalogs?

Importing custom catalogs for apparel from other suppliers

How do I see a detailed breakdown of cost and price of apparel?

How do add additional apparel styles or colors to a quote or sales order?

Apparel Decoration Order Guide

Master Guide to Apparel Decoration

MSRP Catalog pricing - setting a Fixed price for Apparel items

SanMar apparel catalog integration

Automation & Integrations

Shipping

UPS Shipping Integration - Access Keys

FedEx Shipping Integration

Creating a shipment

Shipping Profiles

APIs

shopVOX API

How does an API work?

What is JSON?

Where can my get my shopVOX API credentials?

What is an API?

Can the shopVOX API accept tracking numbers on shipped orders?

Does shopVOX do custom development?

Setting up the Gmail and Outlook Email Integrations with @mail feature

Master Guide to Automation & Integration

How to update your current contact form integration to include uploaded files

What are some popular advantages when using Zapier?

How to add form submissions as Sales Leads in shopVOX

How to send Shopify orders to Sales Orders in shopVOX

shopVOX Go!

How to add Third party Shipping account to a Customer ?

I'm having an issue with the shopVOX APIs. Who do I contact?

How do I build my own custom integration?

Does shopVOX integrate with Salesforce?

Does shopVOX integrate with Microsoft Project?

How Purchase orders work in shopVOX

Setting up Mailchimp integration

Customize your account with Add-on Features

Scheduled Actions - What are they and what can I do with them

API/WebHooks integration feature

Setting up Constant Contact integration

FAQs

shopVOX specific terms

What happens when a Job is completed?

QuickBooks - Classes

Key terms explained

Divisions Add-On

Uploading vs Linking Assets

Why doesn't Material have Volume Discount, only Range Discount?

What does Capacity in Minutes mean?

Common questions

Why can't I print the PDF documents directly, instead of downloading?

How can I print invoices to mail to my customers?

I can't use my email address? shopVOX says email has already been taken.

How do I re-activate the disabled user?

How can I send a quote and a proof together in one email to my customer?

Where do jobs "fit" in the order process in ShopVOX?

What is the Admin checkbox for when creating a new user?

How to Set Up and Use the Inventory Feature

How can I change the workflow template for a job?

How Can I Upload an Image of a Product on a Job Line Item?

Customers- Credit Limits, Stop Supply & Disable

What Does "Group" Mean When Creating a New Customer?

New to Quickbooks While Using ShopVOX

How to increase Database size ?

Hex Color file to match PMS color chart

Can customers download uploaded proofs?

How do I update contact info?

How can I raise a PRO-FORMA or DOWN-PAYMENT Invoice?

How do I add new products?

Can we chat internally with other users?

How to enable login only from static IP address

How can I delete a job?

Who should be assigned the Customer Review step in online proofing?

Opening PDFs directly in your browser

How to hide the thumbnail image in proof emails

What does the number next to workflow steps mean?

Bulk deleting customers

Optimization tips for the Job board

Errors and Troubleshooting

How do I remove / delete materials, material types, or material categories?

When I convert a quote to a work order, does the name of the order and the line item description carry forward or do I have to rewrite?

shopVOX Chat Feature not working on Firefox Browser

How to clear history from Chrome browser?

Flags to control what prints on customer facing vs internal PDFs

Keep Important Documents Handy with Account Level Assets

How to round your pricing to 2 decimals or 4 decimals

ERROR - Property: amount_in_cents, reason: greater than payment balance.

Control custom line items

Existing Approved Proofs for ReOrders

Advanced Search & Filters

How do I cancel my account?

Powerful Global Search in shopVOX

How can I setup a minimum order amount?

How to optimize your browser for shopVOX

Unable to change the Customer on Order ?

Asset Images and using Image Notes

What is our IP address for the mail server ?

Custom PDF in shopVOX

shopVOX Job Board version

eCommerce

Taking Payments in ShopVOX - what your customers will see

Setup a private storefront for your clients to place orders with a cPortal

How do I enable the free cPortal for a customer?

What is the difference between the Paid and Free versions of cPortal?

Online Ordering Account settings for cPortals & Shopping Cart

How is online payment processing set up?

Webstore & Shopping Cart Examples from shopVOX Users

Webstores for your customers - What are they? and... How to setup!

How to setup Products for a given customer to be able to order from cPortal?

White Label setup instructions

Steps to setup custom URL for paid cPortal

Setting up a Shopping Cart to sell online

What will my customers see on their cPortal?

Webstore vs Shopping Cart

How to create a Discount Code in the eCommerce feature

- All Categories

- Accounting and Reporting

- QuickBooks Desktop

- How to Sync to Quickbooks Desktop

How to Sync to Quickbooks Desktop

Updated

by Aaron Aldrich

Updated

by Aaron Aldrich

Now that you are all setup and ready to go, you can sync to your Quickbooks company. Here are the steps you will do to sync your transactions.

How to Sync to Quickbooks Desktop

Step 1. Go to the QBD Sync Invoices / Payments

Click your Company Menu > Account Settings > QBD Sync Invoices/Payments

Step 2. Familiarize yourself with the dashboard and how the sync works

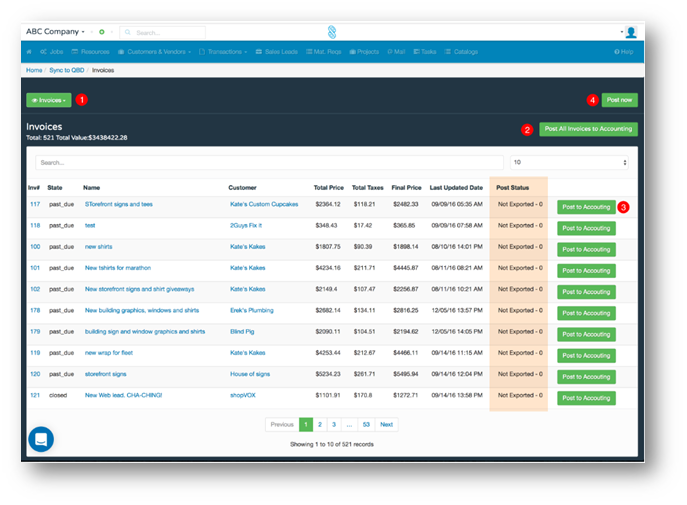

Here's a quick rundown of the most important functions:

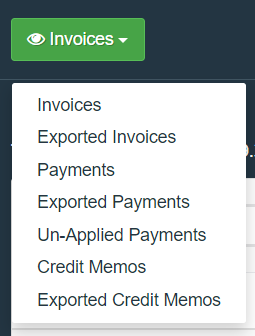

- Use this green drop down to switch between Invoices, Payments, Credit Memos, Un-Applied Payments and Purchase Orders. You'll need to do each one separately to ensure everything goes as smooth as possible.

There are two ways to select Invoices you want to sync.

- Post All Invoices to Accounting - this will select all the invoices (521 in the example below) and prepare them to be synced.

- Post to Accounting - this allows you to actually pick and choose which invoices you'd like to sync. Simply select the Post to Accounting button beside each invoice you want to send.

- Before data gets synced to Quickbooks, you need to actually start the sync.

- To start the sync, simply click the Post now button.

- Refresh your browser to update the page after about a minute.

- The Post Status column will let you know what the Quickbooks status is for that invoice. Any errors that occur will also show up here.

Now you're up to speed - let's cover the steps to do a complete sync.

Step 3. Verify the QB Web Connector is running

It's very important to make sue that the Web Connector is up and running on your computer.

It will most likely be hidden in the task bar. You could also find it by searching the "Start" menu.

Step 4. Sync Invoices first

Either manually select the individual invoices you'd like to post by clicking Post to Accounting. Or click the Post All Invoices to Accounting button to select all invoices.

NOTE: If this is your very first sync, try posting only a single invoice. This keeps your potential for bad data in Quickbooks to a minimum - and saves you from wasted time :)

Post the Invoices

Any invoices that are going to be synced will be marked as "Post Requested".

If you picked one by accident, just click Un-Post to leave it out of this sync.

Once you're ready - click the Post now button.

Refresh the Page

Once you start the sync, the Post now button will change to Post in progress... to let you know the sync is happening.

Wait a few moments for this to process and send data to the Web Connector (longer if your posting lots of invoices.

Refresh the page to check status - shopVOX will not refresh it automatically.

Step 5. Sync Credit Memos second

Follow the same exact procedure outlined before to sync Credit Memos.

- Click the green drop down button

- Select Credit Memos

- Wait for the page to load

- Select the Credit Memos to Post

- Click the Post now button

- Wait for sync and refresh the page

You may not actually have any credit memos to sync. That's good :)

Soldier on.

Step 6. Sync Payments next

Select Payments from the green drop down button

Post the Payments

Either manually select the individual payments you'd like to post by clicking Post to Accounting. Or click the Post All Payments to Accounting button to select all payments.

NOTE: Again - If this is your very first sync, try posting only a single payment first to verify. Better to be safe and test small.

Step 7. Sync Un-Applied Payments

Select Un-Applied Payments from the green drop down button

Post the Un-Applied Payments

Occasionally you may run into an issue where things happen in reverse.

The recommended order is to sync the Invoice before you sync the Payment that was applied to that particular invoice. This helps ensure the payment gets applied correctly in Quickbooks.

For example - you take a down payment for a Sales Order. That Sales Order doesn't get completed for two weeks and the Payment gets synced to Quickbooks before an Invoice is created.

The Un-Applied Payments section lets you update these transactions without the trouble of manually updating in your Quickbooks file.

To sync Un-Applied Payments - just follow the same procedure (you've got it down now.)

- Select the Un-Applied Payments to Post

- Click the Post now button

- Wait for sync and refresh the page

Step 8. Check the Exported sections to verify the sync

Super simple last step.

You can view the transactions and payments that were synced successfully by choosing the Exported Invoices or Exported Payments sections from the green drop down button.

Troubleshooting

The Quickbooks Web Connector is not running or working correctly.

If you're having issues with the Web Connector - try this.

- Open Quickbooks

- Open the File menu

- Select Update Web Services

This should open the Web Connector for you.

If you still can't get it to work - no worries! We'll get you sorted out. Contact our support team inside the app or shoot us an email at support@shopvox.com

I'm getting some really strange errors that don't make any sense to me.

If any issues occur during the sync - Quickbooks usually reports that info back to us - so we can try to diagnose the error.

However, the result is usually not easy to read or decipher.

It might read like this:

StatusCode: 3120; Object "5EED-1464989631" specified in the request cannot be found. QuickBooks error message: The name of the list element is already in use.

We compile a list of these common errors and try to translate them into plain English (which is not always easy).

-> Check out this article for solutions to common errors with Quickbooks Desktop Sync

The sync keeps hanging up for a really long time.

Stuck in Post in progress... for over 10-15 minutes?

It just keeps spinning and spinning and spinning.

Something is definitely wrong here. This usually means there's an issue with the Web Connector, but not always.

Follow this procedure to get things back on track.

Find the Account Settings > Settings menu

Try to troubleshoot any errors and Reset Processing

On the Account Settings > Settings page, scroll down to the Quickbooks Desktop section.

- Check the Sync error details field and look for any potentially error codes that fit the ones from our common error article.

- Click the Reset Processing button. This should clear the sync process and give you a chance to start over.

- At this point - it's a good idea to only try to post one transaction at a time - until you discover the root main cause.

- If you can't figure it out, don't spin your wheels very long. Just reach out to our chat support team inside the shopVOX app - or email us at support@shopvox.com